|

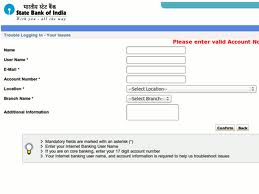

| SBI Online |

Nowadays, internet has

become the most powerful platform for whatever you want to do. It is a

potential medium that can take a ‘finger in every pie’ role in everything from

education, shopping to money transaction. Online money transfer is a good means

not to go out of home and yet do the transactions in the safest way. SBI Online

is a pioneer in this regard. The trust and transparency with which the leading

financial houses operate is really amazing. Online money transfer has every

making of becoming the first-rated choice for the laymen and business

professionals as well.

The very best qualities

that you will discover about online transaction are speed and security. Several

times you may feel of transferring money overseas just within blink of an eye. May

be your parents are in badly need of

hard cash or one of your friends has asked for some financial help during his

foreign trip. You wish you could have been there! However, your money can reach

them within no time (literally speaking) via online money transfer

possibilities.

|

| Thai Exchange Rate |

Apart from banking sector,

there are some institutes dedicated to money transferring activities. They

offer faster service because they have come into being so as to fulfill this

particular purpose only. They always keep an unblinking watch on the exchange

rate in the international money market and so can suggest you on transferring

money at the peak time so that you get a good value for currency conversion.